If you’re contemplating homeownership and wondering where to start, educate yourself first on what a mortgage is and all that goes along with it.

Getting a mortgage is a major step in buying a home, and being equipped with knowledge of the way mortgages works will put you one step ahead of other buyers. First, utilize a house payment calculator and compare it with your budget to determine your price range.

Table of Contents

What is a mortgage?

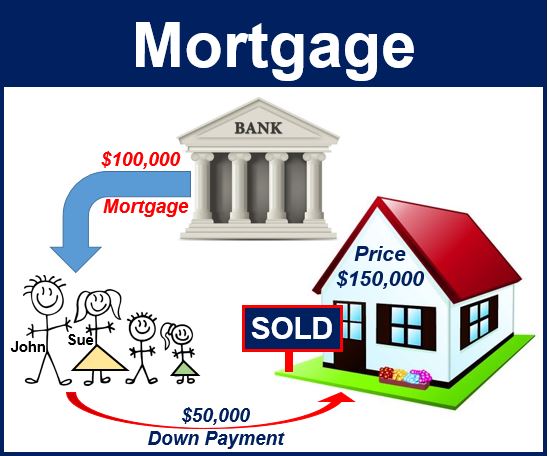

In this case, you are the borrower. A mortgage is an agreement between the borrower and the lender to buy a home without having the full cash payment upfront. This agreement gives lenders the legal rights to repossess a property if the borrower fails to meet the terms of the mortgage by not repaying the money that’s been borrowed, plus interest.

Is there a difference between a loan and a mortgage?

In general, a loan is any financial transaction where one party receives a specified sum of money and agrees to pay the money back to the lender.

A mortgage is a type of loan, used to finance property and is also considered a “secure” loan. This is because the borrower promises collateral to the lender in the event payments are not met. The collateral is the home itself.

How do they work?

Mortgage types can vary, but the most common is a 30-year, fixed-rate mortgage. This means you have 30 years to pay back the loan, and the money will be broken down into 360 monthly payments.

As far as interest rate goes, a fixed rate means the total interest cost is predetermined. This is good because you’ll know from the beginning exactly how much interest you’ll pay over the life of the loan. Your lender can never increase your rate.

Therefore, your monthly payments will always be the same, which goes a long way when determining monthly living budgets.

Does this mean I’m locked in for that amount of time?

No, a 30-year mortgage does not mean you have to stay in the home for the duration of that 30 years, or until the loan is paid back. In fact, most homeowners don’t do this.

If you move and sell your home before it’s paid off, part of the proceeds from the home sale will be used to pay off any remaining loan amount owed to your mortgage lender.

Or, if you decide you want a different type of loan or a lower interest rate later on, you can refinance your mortgage.

What are the benefits of a mortgage?

A mortgage makes home-buying more accessible. It eliminates the need to fully pay for the home in cash and gives homeowners a chance to pay for the house in affordable monthly payments.

Often, a mortgage payment is equal to or less than the cost of rent. Rent prices are currently rising steadily, and renters have nothing to show for their monetary investment.

In addition, mortgages are flexible, so you have a lot of control over your loan terms and your monthly costs.

For More Update Visit Theinspirespy